Solar photovoltaic (PV) panels require no moving parts with very little maintenance. They generate electricity without any noise, fuel waste, or air pollution. They can be installed on a roof, on the ground, or even as a carport canopy in a parking lot. Most importantly, solar PV systems can significantly reduce electric utility costs for decades. At the end of the day, none of these benefits will matter if the cost of a solar PV system is prohibitive. Thankfully in today’s solar market, there are financing models used to grow this popular form of renewable energy.

Currently, there are two primary financing options for an organization looking to utilize solar power for their facilities. The first option is direct ownership, which is a straight-forward purchase where, with the help of incentives and grants, a public entity can finance and own the system outright. The second option, third-party ownership, involves an investor who actually owns the system but engages in a contract for a predetermined electric rate. Each model has advantages and disadvantages that must be examined in order to meet current and future goals of the organization. With the current solar panel costs and efficiencies, there is a legitimate opportunity for solar as the financing and sustainable solution of the future.

Direct Ownership

There is an assortment of financing tools and mechanisms that allow an owner to purchase solar power systems directly. The advantage of this direct ownership is the retention of all rights to the system. The ancillary benefits include, but are not limited to, the electrical savings, rebates, incentives, environmental certificates and solar renewable energy credits (SREC’s). The funds gained through utility bill reduction can be used to repay the loan or bond with the remaining balance added to the budget or general fund. The variant approaches to direct ownership are:

- Bonds – There are a variety of bonding opportunities available. Qualified tax credit bonds (QTCB) have often been used to finance solar projects. Clean Renewable Energy Bonds, Qualified Energy Conservation Bonds, Qualified Zone Academy Bonds and Build America Bonds are all financing vehicles that have been used. While these bond opportunities come and go, public entities may still have allocations available from past years that can be used to finance solar projects. It’s important to stay vigilant as new QTCB forms will be made available in the future.

- Tax-Exempt Leasing – Leasing equipment is a common way to finance hard assets. Receiving federal tax incentives can be difficult, making this method challenging. In certain situations, the low cost and familiarity of tax-exempt leasing combined with other local incentives may outweigh the disadvantages.

- Grants/Fundraising – Grants fit very well into a solar finance model. Grants are made available through local or state governments and many utility companies are now starting to offer public sector grants as an incentive for adding solar. Fundraising can take many different shapes depending on interest from private donors and the community. Performance Services provides classroom learning grants with every solar project.

- Cash On Hand – The use of cash on hand is unlikely in the current economic environment but not in all cases. Organizations may obtain the capital resource or a portion thereof to purchase a solar system through the sale of land, buildings, equipment, or other unused assets.

- Property Assessed Clean Energy (PACE) – This is a simple and effective way to finance renewable energy solutions. Municipal governments in select states offer specific bonds and loans towards clients to put towards energy projects. The project costs are repaid for up to 20 years with an assessment added to the property tax bill.

Capital commitment is the main disadvantage, as many organizations may not have the cash reserves or the bonding authority to access financial mechanisms needed. In some cases, the appropriate funds could be available, but there are more pressing facility renovation issues. During building construction or renovation projects, there are electrical improvements that can be made to lower the cost of future solar installations. By ensuring the electrical distribution panels are able to handle solar panels and the appropriate conduit channels are installed, facilities can be prepared for the possibility of this future installation.

Third-Party Financing

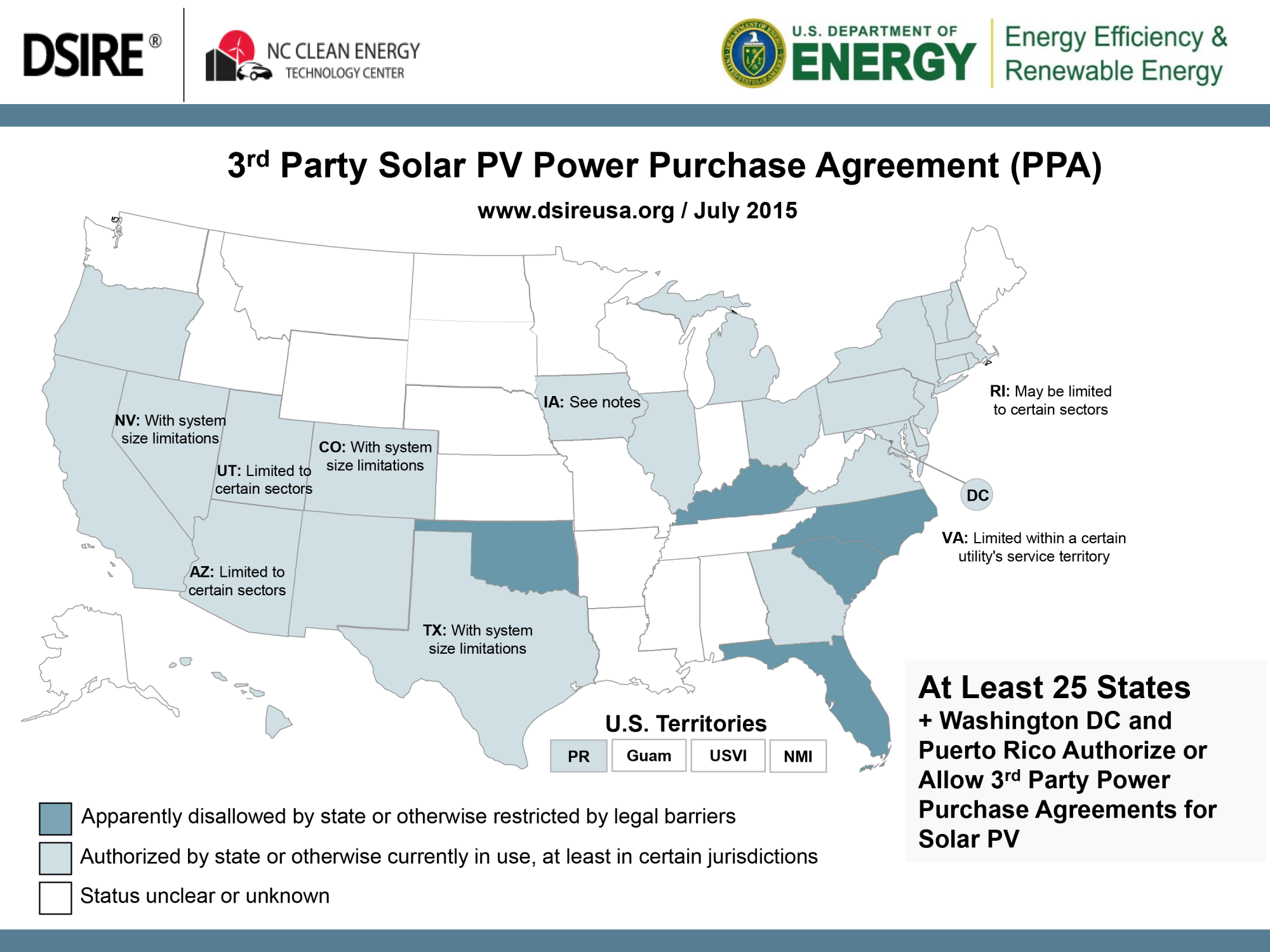

The use of third-party financing is common in unregulated states. This is a viable option for non-tax paying entities to benefit from federal incentives to go solar. Third-party financed solar systems are owned and operated by an outside and separate party. This could be a developer, investor, bank or even a community. The most common third-party financing approach is through a Power Purchase Agreement (PPA). This provides a building owner stable and predictable electricity prices for decades and allows for the purchase of the solar system at the end of the contract for a fair market value, typically pennies on the dollar. Here are three main variations of the third-party financing option:

- Standard Power Purchase Agreement (PPA) – This is the most common approach to a third-party ownership agreement. Under the terms of a PPA, the investing entity owns, operates and maintains the solar system and sells 100% of the electricity production to the organization. The electricity cost is a set over the length of the contract, typically 10-30 years, and can be a fixed cost or include escalation, which still may be less than the average utility rate increases.

- Community Owned PPA’s – This financing model is similar to the standard PPA, but the owners of the system are members of the local community. The benefit of this method is that the members of the community offer financial support while also earning a return on their investment.

- Hybrid Approach – Similar to standard PPA’s, a private solar investor owns the system, but the local government provides the investor with low-cost project capital. In turn, this reduces the contracted price paid for the electricity production over the contract term.

*Figure above shows which states have legislature allowing third-party PPA financing.

Power purchase agreements do not allow the utilization of ancillary benefits of a solar system. Environmental benefits, local/state/utility incentives, solar renewable energy credits are all claimed by the system owner. PPA’s are contracts that are labor intensive and will typically have high transaction costs. Typically this financing mechanism works best with large systems, which can be remedied through the installation of many smaller systems. Also, since the owner is responsible for operations and maintenance, third party open access to the facility grounds is necessary. When a PPA option is available and the advantages outweigh the disadvantages, a PPA agreement can be favorable.

Finding a Solution

Solar power system financing is just one piece to this renewable energy pie. In order to make an informed decision, it is crucial to find a knowledgeable partner who will lead an organization through initial assessment, system design, financing, engineering, construction, and performance assurance. Each step is an integral piece when looking for the best possible solar energy solution. Financing a renewable energy project can be challenging, but following an energy master plan can keep a facility on track for a sustainable and affordable future.

Ready to Go Solar? Contact us below!

Meet the Author